Growing businesses face a painful paradox: They need CFO-level strategic thinking but can't afford (or don't yet need) a £120k+ full-time executive. The result? Overpromoted bookkeepers, overstretched founders, and financial decisions made without proper rigour. The Virtual CFO model solves this: C-suite financial expertise on a fractional, scalable basis. Here's how it works and when it makes sense.

The Finance Leadership Gap

Most SMEs progress through predictable finance evolution stages:

Stage 1: Founder-Led Finance (£0-£1M revenue)

- Founder handles invoicing, payroll, basic bookkeeping

- Accountant does year-end compliance and tax return

- Works when: Transactions are simple, cash flow is manageable

- Breaks when: Complexity increases, founder has no time, decisions need financial rigour

Stage 2: Bookkeeper/Part-Time Accountant (£1M-£5M)

- Hire bookkeeper to manage AP/AR, payroll, reconciliations

- External accountant produces monthly management accounts

- Works when: Financial reporting is accurate, operations are stable

- Breaks when: Need for strategic finance (forecasting, fundraising, scenario modelling, M&A)

Stage 3: Finance Manager/Controller (£5M-£15M)

- Promote bookkeeper or hire finance manager

- Manages day-to-day finance operations, produces reports

- Works when: Transactional finance is under control

- Breaks when: Need for board-level financial strategy, investor relations, corporate finance

Stage 4: Full-Time CFO (£15M+)

- Hire experienced CFO (£100k-£200k+ salary + benefits)

- Strategic finance leadership, board member, investor-facing

- Works when: Complexity, scale, and risk justify the investment

The Problem: The gap between Stage 2 and Stage 4 is enormous. Businesses at £3M-£10M revenue need strategic finance but can't afford or don't need a full-time CFO. Promoting the bookkeeper to "Finance Director" doesn't work—skillset mismatch. Hiring an expensive CFO too early burns cash and creates overhead.

What Is a Virtual CFO?

A Virtual CFO (also called Fractional CFO, Interim CFO, or Part-Time CFO) provides CFO-level expertise on a flexible, part-time basis:

- Not a bookkeeper: Handles strategy, not transactions

- Not a consultant: Embedded in the business, accountable for outcomes

- Not full-time: Engaged for 1-3 days/week (or as needed)

Core Responsibilities

1. Strategic Financial Planning

- Build financial models (revenue forecasts, scenario planning, sensitivity analysis)

- Develop 3-5 year strategic plans linked to business objectives

- Design KPI frameworks and management dashboards

2. Fundraising and Investor Relations

- Prepare investor decks, financial projections, data rooms

- Lead due diligence processes (equity, debt, grants)

- Negotiate term sheets and loan agreements

- Manage investor reporting and board packs

3. Financial Systems and Controls

- Implement or upgrade accounting systems (Xero, QuickBooks, NetSuite)

- Design internal controls, approval workflows, segregation of duties

- Build budgeting and forecasting processes

4. Corporate Finance Transactions

- M&A buy-side or sell-side support (valuation, negotiation, integration)

- Restructuring and turnaround (cash flow crisis, creditor negotiations)

- Exit preparation (clean up financials, build equity story, manage sale process)

5. Board and Leadership Support

- Attend board meetings, present financial performance

- Partner with CEO on strategic decisions (pricing, capex, hiring)

- Coach and develop junior finance team

When You Need a Virtual CFO

Trigger Scenarios

1. Preparing for Fundraising

Investors demand rigorous financial models, clean historicals, and credible projections. Your bookkeeper can't build these. A Virtual CFO can:

- Produce investor-grade financial models (3-statement, DCF, unit economics)

- Clean up historical financials and ensure audit-readiness

- Lead investor roadshows and due diligence

2. Scaling Rapidly

High growth creates financial complexity (cash flow strain, working capital management, pricing strategy). You need someone who's scaled businesses before.

3. Facing a Crisis

Cash flow problems, covenant breaches, or distressed situations require immediate, experienced intervention. Virtual CFOs specialise in turnarounds.

4. Considering M&A

Buying or selling a business demands specialist skills: valuation, negotiation, due diligence, integration. Most SME finance teams lack this experience.

5. Professionalising Finance Function

Moving from spreadsheets to proper systems, building forecasting capability, implementing controls—all require someone who's done it before.

6. Managing Complex Stakeholders

Dealing with banks, PE investors, or boards requires CFO-level communication and credibility.

Virtual CFO vs. Full-Time CFO: The Trade-Offs

| Factor | Virtual CFO | Full-Time CFO |

|---|---|---|

| Cost | £2k-£8k/month (depending on time commitment) | £120k-£200k/year + benefits (£12k-£20k/month) |

| Availability | 1-3 days/week, flexible | Full-time, always available |

| Experience | Typically 15+ years, multi-industry, seen many scenarios | Varies (could be first CFO role) |

| Scope | Strategic focus (leaves day-to-day to finance team) | Strategic + operational |

| Commitment | Flexible, can scale up/down | Permanent hire, exit costs |

| Best For | £2M-£15M revenue, project-based needs, interim coverage | £15M+ revenue, complex operations, ongoing strategic role |

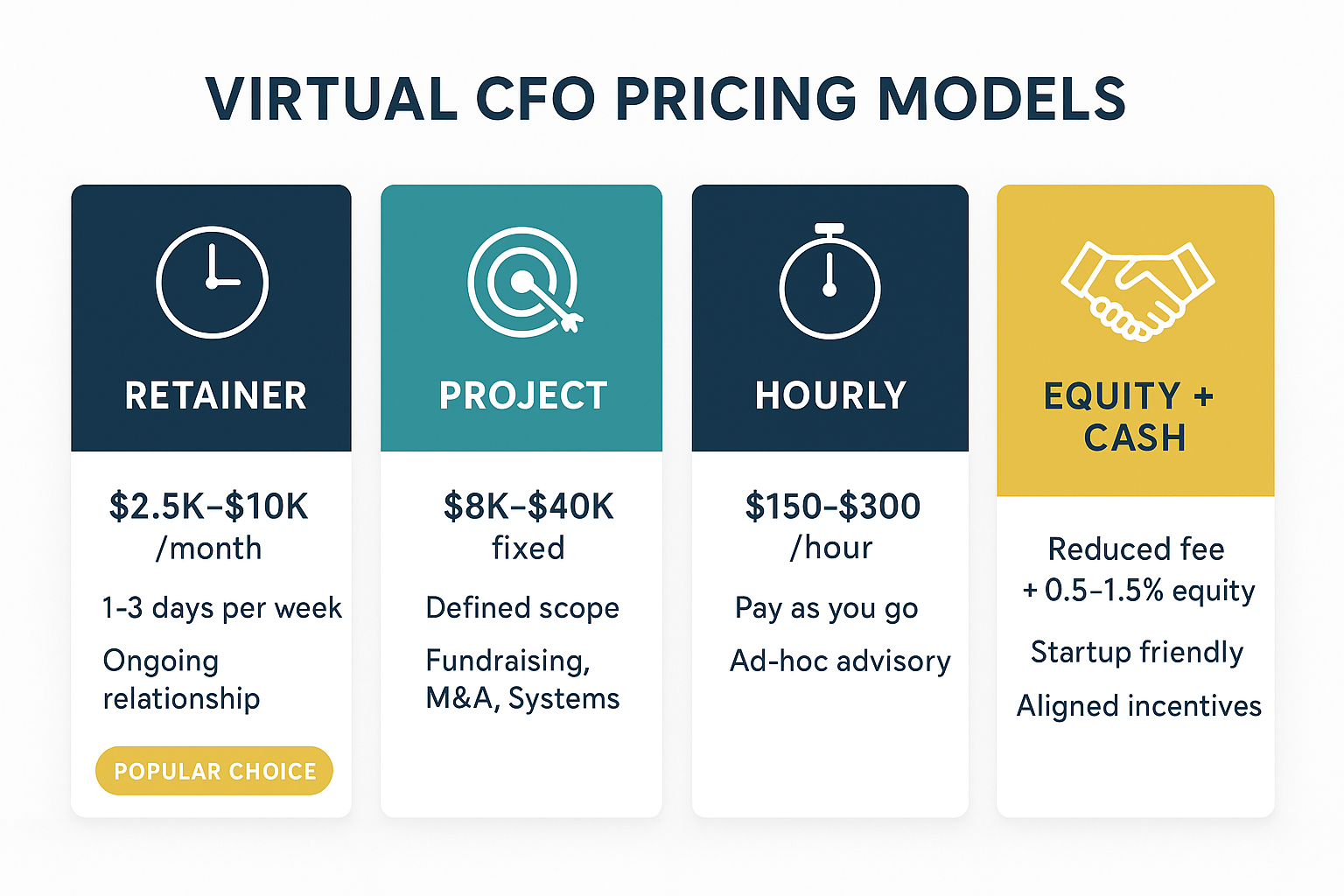

Pricing Models

1. Retainer (Most Common)

Fixed monthly fee for agreed time commitment:

- 1 day/week: £2,500-£4,000/month

- 2 days/week: £4,500-£7,000/month

- 3 days/week: £6,500-£10,000/month

Pros: Predictable cost, ongoing relationship, responsive to ad hoc needs

Cons: Pay for time whether you use it or not

2. Project-Based

Fixed fee for defined deliverable:

- Fundraising support: £15k-£40k (depends on round size, complexity)

- Financial model build: £8k-£20k

- Due diligence (buy-side): £10k-£30k

- System implementation: £12k-£35k

Pros: Clear scope, defined outcome, budget certainty

Cons: Less flexible, doesn't cover ongoing needs

3. Hourly

Pay per hour worked:

- Typical rate: £150-£300/hour (depending on experience, location)

Pros: Only pay for what you use

Cons: Unpredictable cost, can create perverse incentives (more hours = more revenue)

4. Equity + Cash (Start-ups)

Reduced cash fee + equity stake:

- Example: £3k/month + 0.5-1.5% equity (vesting over 2-4 years)

Pros: Aligns incentives, conserves cash

Cons: Dilution, governance complexity

How to Structure the Engagement

Step 1: Define Objectives (Week 1)

Be clear on what you need:

- Prepare for Series A fundraise (6-month project)

- Build FP&A capability (12-month engagement, then transition to internal hire)

- Navigate cash flow crisis (3-month turnaround)

- Ongoing strategic finance support (open-ended retainer)

Step 2: Agree Scope and Deliverables

Document responsibilities:

- In scope: Financial modelling, board reporting, investor relations, strategic planning

- Out of scope: Bookkeeping, payroll, AP/AR processing (handled by existing team)

Step 3: Set Time Commitment and Rhythm

- Regular cadence: Every Tuesday + Thursday (2 days/week)

- Board meetings: Attend monthly

- Availability: Responsive via email/Slack between visits

Step 4: Integrate with Existing Team

- Virtual CFO supervises bookkeeper/finance manager

- Weekly check-in with CEO

- Access to systems (accounting software, bank accounts, payroll)

Step 5: Review and Adjust (Quarterly)

- Assess whether time commitment is right (scale up/down)

- Review deliverables and priorities

- Plan transition to full-time CFO if business scales

Real-World Examples

Case 1: Engineering Start-Up (Pre-Revenue to Series A)

Challenge: Founders (technical backgrounds) needed to raise £2M Series A. No financial model, messy books, no investor experience.

Virtual CFO Engagement:

- Scope: Build financial model, clean up accounts, lead fundraise

- Time: 2 days/week for 6 months

- Fee: £5k/month + 0.75% equity

Deliverables:

- Investor-grade financial model (5-year projections, unit economics, scenario planning)

- Cleaned up 2 years of historical financials

- Led investor roadshow (15 meetings), negotiated term sheet

- Managed due diligence and legal process

Outcome: Raised £2.3M at £12M valuation. Virtual CFO transitioned to quarterly advisory role post-close.

Case 2: Manufacturing SME (£8M Revenue, Growth Plateau)

Challenge: Profitable but stagnant. Finance manager produced accounts but no strategic insight. CEO wanted to understand profitability by product line and plan for growth.

Virtual CFO Engagement:

- Scope: Implement management reporting, build driver-based forecast, advise on strategy

- Time: 1 day/week ongoing

- Fee: £3.5k/month

Deliverables:

- Implemented product-line P&L (revealed 2 unprofitable lines)

- Built rolling 12-month cash flow forecast

- Created monthly board pack (KPIs, variance analysis, commentary)

- Advised on pricing strategy, capex decisions, and acquisition targets

Outcome: Discontinued unprofitable products (£140k annual cost saving), invested in high-margin lines, grew revenue 18% and EBITDA 35% over 18 months.

Case 3: Retail Business (Cash Flow Crisis)

Challenge: Rapid expansion drained cash. Facing covenant breach, creditors pressing, no liquidity headroom.

Virtual CFO Engagement:

- Scope: Turnaround—stabilise cash, renegotiate bank terms, restructure operations

- Time: 3 days/week for 4 months (crisis mode)

- Fee: £8k/month

Actions:

- Built 13-week cash flow forecast (daily monitoring)

- Negotiated creditor payment plans (extended terms, avoided legal action)

- Renegotiated banking covenants (secured 6-month waiver)

- Closed 2 loss-making stores, renegotiated leases on remaining sites

- Implemented weekly cash meetings with CEO

Outcome: Stabilised cash position, avoided insolvency, returned to profitability within 9 months. Transitioned to 1 day/week advisory role.

Common Mistakes to Avoid

1. Hiring Too Junior

Don't hire someone claiming to be a "CFO" with only 5 years' experience. Virtual CFOs should have 15+ years, ideally across multiple industries and growth stages.

2. Treating Them Like a Consultant

Virtual CFOs aren't external advisors—they're part of your leadership team. Give them access to systems, data, and decision-making forums.

3. Asking Them to Do Bookkeeping

Don't waste CFO-level expertise on AP/AR or reconciliations. Keep a bookkeeper or finance manager for transactional work.

4. No Clear Handover Plan

If the goal is to eventually hire a full-time CFO, define the transition plan upfront. Virtual CFO can recruit and onboard their replacement.

5. Unclear Scope

Document responsibilities, deliverables, and decision rights. Avoid scope creep or misaligned expectations.

When to Transition to Full-Time CFO

Signs it's time to convert to permanent hire:

- Revenue >£15M: Complexity and scale justify full-time focus

- Fundraising complete: Need ongoing investor relations and governance

- IPO or exit planning: Requires full-time strategic leadership

- Complex operations: Multiple entities, international expansion, M&A activity

- Time commitment creeping up: If Virtual CFO is working 4-5 days/week, hire full-time

Transition Strategy: Virtual CFO can recruit their replacement, onboard them, and then step back to advisory role or exit gracefully.

Conclusion: Right-Sized Finance Leadership

The Virtual CFO model solves a critical problem: How to access world-class financial leadership without the cost and commitment of a full-time hire.

It's not a compromise. It's strategic pragmatism:

- Pay for expertise, not overhead (£4k/month vs. £15k/month)

- Access senior talent that wouldn't join your business full-time at your stage

- Scale flexibly as your needs change (1 day/week → 3 days/week → full-time hire)

- De-risk critical decisions (fundraising, M&A, turnarounds) with someone who's done it before

Growing businesses don't need a full-time CFO on day one. But they absolutely need CFO-level thinking. The Virtual CFO model delivers exactly that.

The question isn't whether you can afford a CFO. It's whether you can afford to make financial decisions without one.