Financial models for manufacturing operations are different from services or retail. They must capture operational complexity: capacity constraints, material costs, production efficiency, inventory dynamics, and capital intensity. This guide provides battle-tested best practices for building robust, decision-ready financial models.

Why Manufacturing Finance Is Different

Manufacturing businesses face unique financial challenges:

- Operational Leverage: High fixed costs (facilities, equipment) make profitability sensitive to volume

- Working Capital Intensity: Inventory (raw materials, WIP, finished goods) ties up significant cash

- Cost Complexity: Direct costs (materials, labour) vs. indirect costs (overheads, utilities) require accurate allocation

- Capacity Constraints: Production is limited by equipment capacity, labour availability, and supply chain

- Long Lead Times: Planning horizons are longer than services—investment decisions have multi-year impacts

Traditional financial models built for services businesses fail in manufacturing because they don't capture these operational realities. A good manufacturing model integrates operational drivers with financial outcomes.

The Core Structure: Driver-Based Modelling

The best manufacturing models are driver-based—they link financial outcomes (revenue, profit, cash) to operational inputs (volume, capacity, efficiency).

Key Operational Drivers

- Production Volume: Units produced by product line

- Capacity Utilisation: % of theoretical capacity used

- Yield/Scrap Rate: % of input that becomes saleable output

- Labour Efficiency: Output per labour hour

- Material Cost per Unit: Direct material cost (driven by commodity prices, supplier contracts)

- Energy Consumption: kWh per unit produced

- Changeover Time: Downtime between product runs

Example: Revenue Build-Up

Instead of simply forecasting "£10m revenue," build it from operational drivers:

Revenue = Units Sold × Average Selling Price

Where:

- Units Sold = (Production Capacity × Utilisation% × Yield%) - Inventory Change

- Average Selling Price = Mix-weighted price across product lines

This approach reveals the levers for growth: increase capacity, improve utilisation, reduce scrap, or shift product mix to higher-value items.

Building the Model: A Practical Framework

Here's the architecture for a robust manufacturing financial model:

Tab 1: Assumptions & Inputs

Centralise all key assumptions in one tab. This includes:

- Revenue Assumptions: Volume growth rates, pricing, product mix

- Cost Assumptions: Material cost per unit, labour rates, overhead allocation rates

- Operational Assumptions: Capacity (units/year), utilisation%, yield%, changeover times

- Working Capital Assumptions: Inventory days, receivables days, payables days

- Capex Assumptions: Planned equipment purchases, facility expansions

- Macroeconomic Inputs: Inflation, FX rates, energy costs

Best Practice: Use colour coding (blue for inputs, black for formulas, green for links from other tabs). Make it obvious what can be changed.

Tab 2: Revenue Model

Build revenue from the bottom up by product line:

| Product Line | Volume (units) | Price (£/unit) | Revenue (£k) |

|---|---|---|---|

| Product A | 50,000 | £25 | £1,250 |

| Product B | 30,000 | £40 | £1,200 |

| Product C | 20,000 | £60 | £1,200 |

| Total | 100,000 | - | £3,650 |

Link volume to capacity constraints (you can't sell more than you can produce).

Tab 3: Cost of Goods Sold (COGS)

Break down COGS into components:

- Direct Materials: Raw material cost per unit × units produced

- Direct Labour: Labour hours per unit × labour rate × units produced

- Manufacturing Overheads: Utilities, maintenance, depreciation, indirect labour

Key Decision: Use absorption costing (allocate fixed overheads to units) or marginal costing (treat fixed overheads as period costs). For internal decision-making, marginal costing is often clearer. For external reporting, absorption is required.

Tab 4: Operating Expenses (OPEX)

Separate fixed and variable OPEX:

- Fixed: Salaries, rent, insurance (don't vary with volume)

- Variable: Sales commissions, logistics costs (scale with volume)

This distinction is critical for scenario analysis—fixed costs don't flex, variable costs do.

Tab 5: Capital Expenditure (Capex)

Model planned equipment purchases, facility expansions, and maintenance capex:

- Growth Capex: Investments to increase capacity or launch new products

- Maintenance Capex: Replacement of worn-out equipment

Link capex to capacity increases. If you're modelling 20% volume growth, ensure you've budgeted the capex to support it.

Tab 6: Working Capital

Manufacturing businesses are working capital intensive. Model three components:

Inventory

- Raw Materials: Days of raw material stock × daily material consumption

- Work-in-Progress (WIP): Value of partially completed goods (use production cycle time)

- Finished Goods: Days of finished goods stock × daily COGS

Receivables

Days Sales Outstanding (DSO) × daily revenue

Payables

Days Payables Outstanding (DPO) × daily material purchases

Net Working Capital = Inventory + Receivables - Payables

Working capital changes drive cash flow. Growing sales increase working capital (cash outflow); improving inventory turns release cash (inflow).

Tab 7: Financial Statements

Pull everything together into three core statements:

Profit & Loss (P&L)

- Revenue

- COGS

- Gross Profit

- Operating Expenses

- EBITDA

- Depreciation & Amortisation

- EBIT

- Interest

- Tax

- Net Profit

Cash Flow Statement

- Operating Cash Flow (EBITDA - working capital change - tax)

- Investing Cash Flow (Capex)

- Financing Cash Flow (debt drawdown/repayment, dividends)

- Net Cash Flow

- Closing Cash Balance

Balance Sheet

- Assets: Cash, receivables, inventory, fixed assets

- Liabilities: Payables, debt

- Equity: Share capital, retained earnings

Critical Check: Balance sheet must balance (Assets = Liabilities + Equity). If it doesn't, you have a formula error.

Tab 8: Scenario Analysis

Build at least three scenarios:

- Base Case: Most likely outcome

- Upside: Volume +20%, pricing +5%, efficiency gains

- Downside: Volume -15%, raw material cost +10%, delayed capex

Use data tables or scenario manager to toggle between scenarios. This reveals financial resilience under different conditions.

Tab 9: KPI Dashboard

Summarise key metrics for decision-makers:

- Revenue Growth %

- Gross Margin %

- EBITDA Margin %

- Cash Conversion Cycle (days) = DSO + Inventory Days - DPO

- Return on Invested Capital (ROIC) = EBIT × (1 - Tax Rate) / (Equity + Debt)

- Debt / EBITDA

- Free Cash Flow = Operating Cash Flow - Capex

Visualise these with charts (line graphs for trends, waterfall charts for cash flow drivers).

Common Modelling Pitfalls in Manufacturing

1. Ignoring Capacity Constraints

Forecasting 30% revenue growth without checking if you have the production capacity to deliver it is a classic error. Always link volume growth to capacity.

2. Overly Simplistic Cost Assumptions

Assuming "COGS = 60% of revenue" misses operational reality. Build COGS from material costs, labour hours, and overhead allocation.

3. Forgetting Working Capital

Profitable companies can run out of cash if working capital isn't managed. Model inventory, receivables, and payables explicitly.

4. Circular References Without Iteration

Interest expense depends on debt, which depends on cash flow, which depends on interest. Use Excel's iterative calculation feature or break the circularity with opening/closing balance logic.

5. Hard-Coding Numbers in Formulas

Never bury assumptions in formulas (e.g., =Revenue*0.6). Put the 0.6 in the Assumptions tab and reference it. This makes the model auditable and flexible.

6. No Sensitivity Analysis

Every model has key drivers (e.g., selling price, material cost, volume). Use data tables to show how EBITDA or cash flow changes when these drivers flex ±10-20%.

Advanced Techniques for Manufacturing Models

1. Product-Level Profitability Analysis

Not all products contribute equally. Build a profitability matrix:

| Product | Revenue | Direct Costs | Contribution Margin | Allocated Overheads | Net Margin |

|---|---|---|---|---|---|

| Product A | £1,250k | £750k | £500k (40%) | £300k | £200k (16%) |

| Product B | £1,200k | £840k | £360k (30%) | £250k | £110k (9%) |

| Product C | £1,200k | £600k | £600k (50%) | £200k | £400k (33%) |

Insight: Product C has the highest net margin—prioritise capacity allocation accordingly.

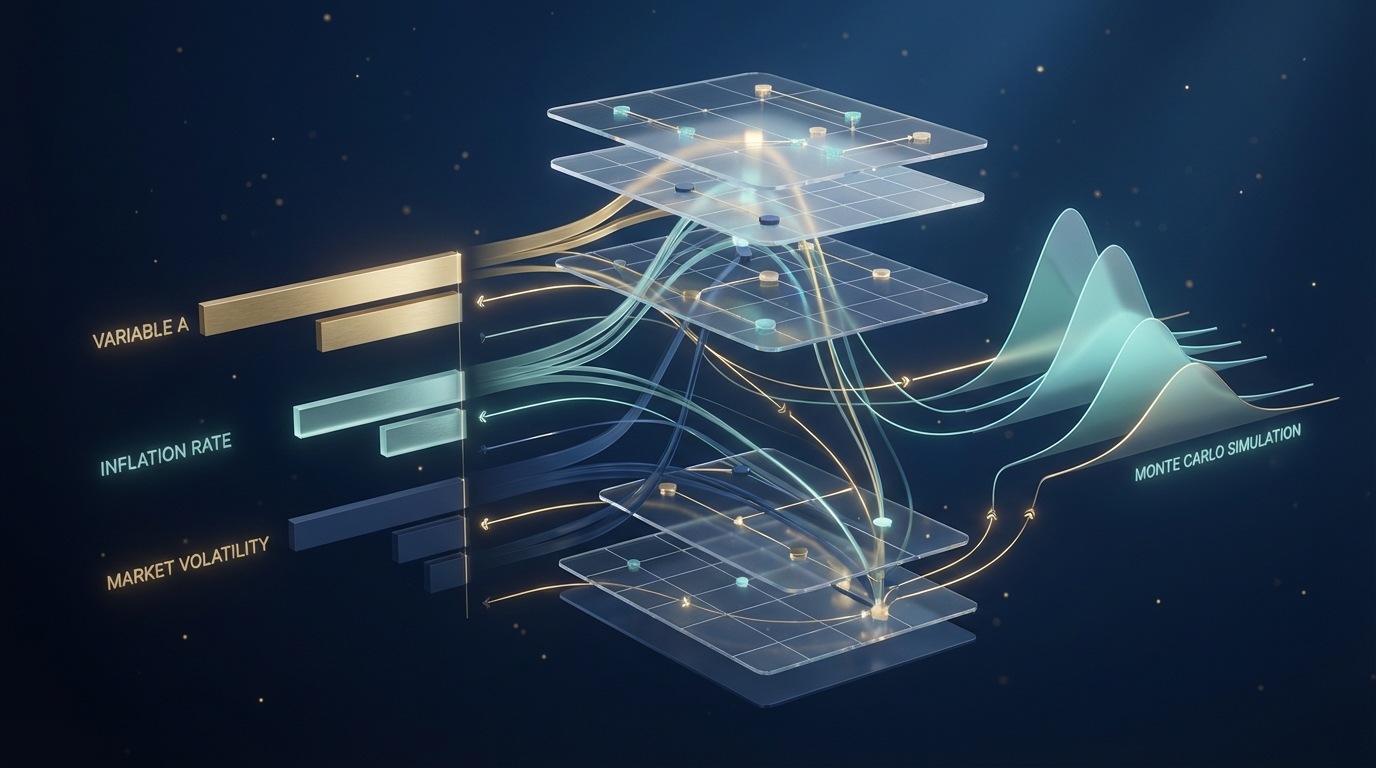

2. Monte Carlo Simulation for Risk Analysis

Use Monte Carlo simulation (Excel add-ins like @RISK or Crystal Ball) to model uncertainty in key inputs (material costs, volume, FX rates). This produces probability distributions for outcomes (e.g., "70% probability of achieving £2m+ EBITDA").

3. Integrated Operational-Financial Models

Link operational metrics (OEE, cycle time, scrap rate) directly to financial outcomes. This allows you to quantify the financial impact of operational improvements.

Example: "Improving OEE from 65% to 75% increases output by 15%, generating £500k additional EBITDA."

Model Governance and Version Control

Financial models are living documents. Establish governance:

- Version Control: Save dated versions (e.g., "Budget_2025_v3_2024-11-15.xlsx")

- Change Log: Maintain a tab documenting changes (who, when, what)

- Access Control: Limit write access; distribute read-only copies for review

- Audit Trail: Use cell comments to explain non-obvious formulas

- Regular Review: Update models quarterly with actuals; recalibrate assumptions

Tools Beyond Excel

Whilst Excel remains the workhorse for financial modelling, consider upgrading for complex scenarios:

- Power BI / Tableau: For dynamic dashboards and visualisation

- Python (Pandas, NumPy): For large datasets, automation, and Monte Carlo simulation

- Anaplan, Adaptive Insights: Enterprise-grade planning platforms with better collaboration and version control

- Custom Financial Models: We build bespoke models integrated with ERP systems for real-time forecasting

Conclusion: Models That Drive Decisions

A financial model is only valuable if it drives better decisions. The best manufacturing models are:

- Driver-Based: Link financial outcomes to operational levers

- Transparent: Assumptions are visible and auditable

- Flexible: Scenario analysis and sensitivity testing are built-in

- Actionable: Outputs inform capital allocation, pricing, and operational priorities

- Maintained: Regularly updated with actuals and recalibrated assumptions

Build models that answer the questions management is actually asking: Can we afford this expansion? What happens if raw material costs spike 20%? Which products should we prioritise?

Get the model right, and you'll transform financial planning from a compliance exercise into a strategic advantage.